Oxfam in Nigeria has sounded an alarm over the troubling trend of massive tax evasion by the country’s wealthiest citizens, as millions of Nigerians continue to suffer from hunger and poverty. The organization disclosed that more than 99% of wealthy Nigerians evade taxes, exacerbating the country’s inequality crisis.

The revelation came during the presentation of two comprehensive reports—“Income and Wealth Inequality in Nigeria: Trends and Drivers” and “Taxing the Rich: Fair Tax Monitor”—in Abuja. The studies, conducted in partnership with the Tax Justice Network Africa and the Civil Society Legislative Advocacy Centre (CISLAC), expose how economic growth in Africa’s fourth-largest economy primarily benefits a small elite, leaving the majority of citizens in poverty.

Alarming Wealth Gap and Inequality Exposed

The reports highlight structural inequalities tied to income, wealth, gender, and regional disparities. Drawing on statistical data, expert analysis, and stakeholder contributions, the findings emphasize that Nigeria’s economic gains are concentrated in the hands of a few individuals, leaving millions in dire conditions.

Oxfam stressed that the wealth gap is reaching unsustainable levels and warned that failure to address the growing divide could lead to a social crisis. The organization called for the urgent adoption of progressive wealth taxation and increased investment in social sectors to reduce poverty and prevent social unrest.

99% Tax Evasion Among the Wealthiest

According to Oxfam, data from the Federal Inland Revenue Service (FIRS) and John Bean Technologies Corporation (JBT) shows that only 40 of Nigeria’s wealthiest individuals comply with tax obligations—representing a compliance rate of just 0.035%. This means that over 99% of the richest Nigerians evade or avoid paying taxes, depriving the country of critical revenue for development.

Key Recommendations from the Reports

To tackle the inequality crisis, Oxfam outlined several policy recommendations for the Nigerian government:

- Increase Social Spending: Currently, Nigeria allocates just 2-3.5% of the budget to education and 4-7% to healthcare—well below international standards. Oxfam recommends raising social sector spending to at least 10% of the budget in education, healthcare, and agriculture.

- Implement Progressive Taxation: Introduce a wealth tax targeting individuals with net worth exceeding $1 million. A 1% tax on these high-net-worth individuals could generate $7.5 billion annually to fund critical social programs.

- Invest in Human Capital Development: Improve education, healthcare, and job creation, particularly in rural areas. Enhancing wages, curbing corruption, and expanding educational opportunities—especially for women and girls—will boost Nigeria’s Human Development Index (HDI) by 2030.

- Support Smallholder Farmers and Reform Agriculture: Strengthen access to credit, land, and infrastructure for smallholder farmers. Oxfam also recommends prioritizing women’s land rights and promoting sustainable farming practices to bridge the rural-urban divide.

- Reform Land Policies: Establish a National Land Commission, conduct a comprehensive National Land Audit, and ensure transparent land redistribution programs with a focus on gender inclusiveness.

- Collaborate with Civil Society: Oxfam urges the government to engage non-state actors, including civil society organizations and community groups, to advocate for pro-poor policies, promote gender equality, and hold the government accountable.

- Develop a Comprehensive Wealth Registry and Strengthen Tax Enforcement: This will help ensure that high-net-worth individuals contribute their fair share to public revenue.

CISLAC’s Proposals to Strengthen Tax Reforms

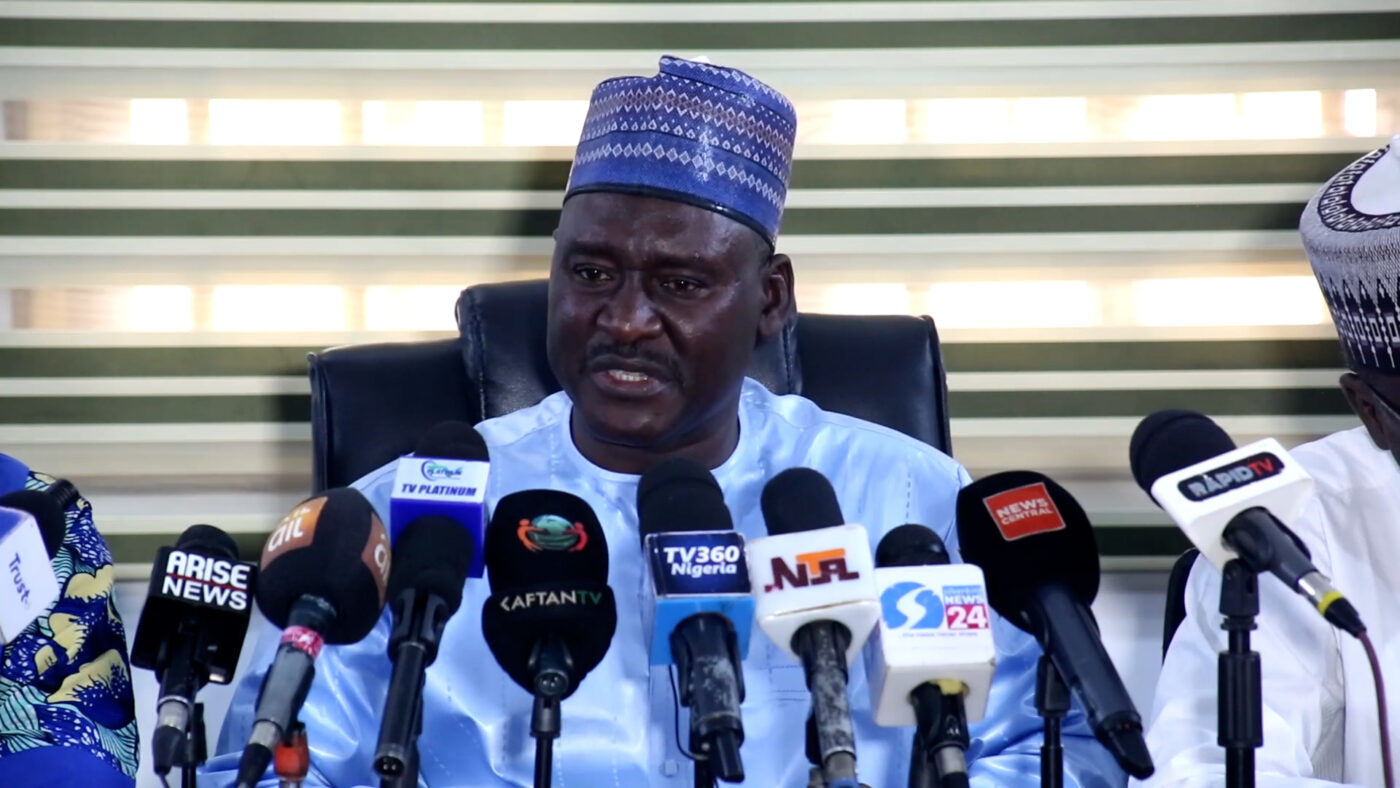

During the event, Anwual Rafsanjani, Executive Director of CISLAC, advocated for the introduction of a Net Wealth Tax and an increase in Capital Gains Tax to align with global best practices. He further urged the government to:

- Exempt low-income earners from Personal Income Tax (PIT). Specifically, those earning below the minimum wage or less than N840,000 annually should be excluded from PIT.

- Introduce luxury taxes on high-end items such as private jets, luxury cars, and yachts.

- Raise the top tax rate to 40% for the wealthiest 1%.

- Introduce an Inheritance and Gift Tax targeting estates valued over N50 million.

- Renegotiate Double Taxation Agreements (DTAs) that disproportionately favor multinational corporations, to enhance Nigeria’s tax sovereignty and increase revenue.

Call for Urgent Action

Oxfam warned that without decisive action, the growing inequality could destabilize the country’s social fabric. The organization emphasized that Nigeria’s wealthy elite must play a greater role in supporting national development through fair taxation.

“Implementing these reforms is not just about raising revenue; it is about justice and equity,” Rafsanjani said, underscoring the need for policies that lift people out of poverty and create a more inclusive society.

The event concluded with a renewed call for the government to prioritize progressive taxation and social investments to foster sustainable development and mitigate the growing threat of inequality.